BOLT ATM Fund

INVESTMENT OVERVIEW

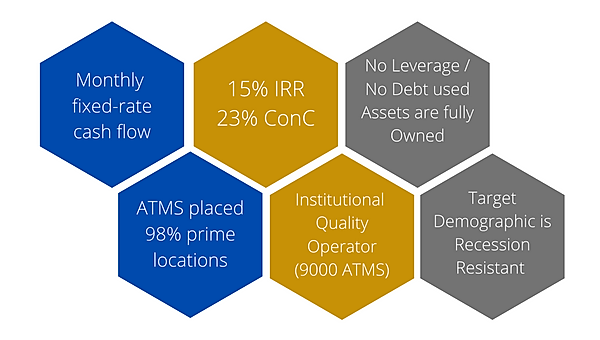

Institutional-quality background of the operator (9,000 ATMs managed across 45 states, $100 million+ equity invested)

98%+ of the ATMs are in prime locations in well-known retailers and locations deemed “essential businesses” during the pandemic

Generous cash flows of 23% average Cash on Cash returns and 15% IRR for a $106,000 investment (22% average Cash on Cash and 14% IRR for a $53,000 investment)

Contractually guaranteed fixed-rate cash flow stream to investors every single month for 7 years

The fund uses no debt and no leverage, the assets are owned 100% outright thus reducing the investment’s risk profile

Fund’s financials allow for an estimated 25%-30%+ reduction in transaction volume prior to the Fund experiencing challenges from operational cash flow

Core target demographic is ATM user is underbanked, credit-distressed and/or heavy cash users; can’t adopt new technologies (Google Pay, Venmo, etc.) that require bank access

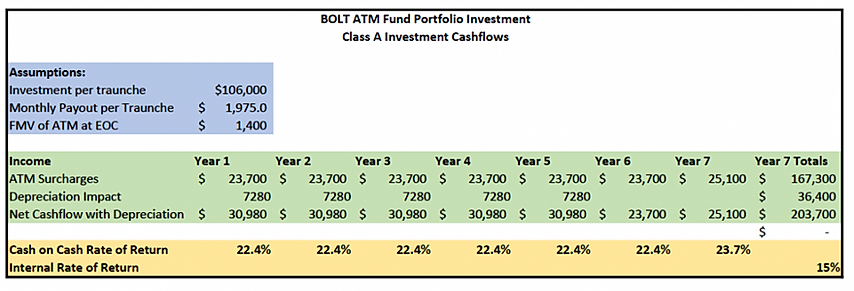

PROJECTED RETURNS

(BASED ON $106,000 INVESTMENT)

23% Cash on Cash Return

15% Internal Rate of Return

$1975 paid monthly ($23,700 yearly)

7-year investment term

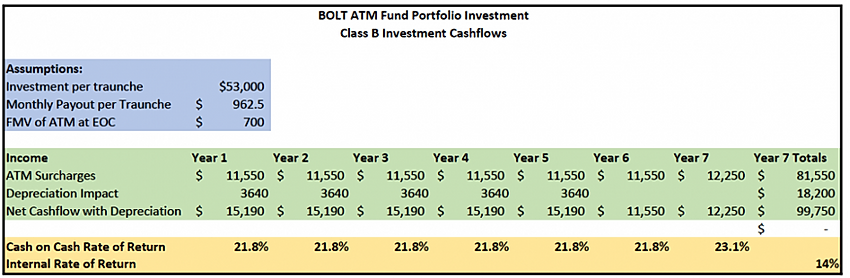

(BASED ON $53,000 INVESTMENT)

22% Cash on Cash Return

14% Internal Rate of Return

$962.50 paid monthly ($11,550 yearly)

7-year investment term

BACKGROUND INFORMATION

During the height of COVID-19 and shelter-in-place orders, when theoretically no one is spending and cant leave the house. The operator only saw a fund-wide reduction of roughly 11% in transaction volume

Fund’s transaction volume has recovered to roughly 98.4% of pre-COVID 19 levels, as of August 2020

Third-party full audits every 2 to 3 to maintain industry-standard certification as an Independent ATM Deployer (IAD)

Conservative underwriting does not include additional value-add upside through digital advertising revenue and data analytics regarding a retailer’s foot traffic

To further align incentives, Altus Investment Group, its partners, and affiliated entities will co-invest over $300,000.

TEAMWORK THAT MAKES THE DREAM WORK

Sponsors: Mary Nguyen, Suja Shyam, John Okocha, Kevin Dugan,

Operators: Prestige Investment Group (Daryll Heller, Will Powers)

Management: Paramount Management Group (Jorge Fernandez)

WEBINAR REPLAY & EXECUTIVE SUMMARY

Click to view the investor webinar. The initial 30 minutes is a brief overview of the investment opportunity, with the Q&A starting at 30:30.

Click to view the webinar slides.

Click to view the detailed executive summary

IMPORTANT INVESTOR GUIDELINE AND TIMELINE

Minimum Investment: $53K

Cash, Self-Directed IRA, or Solo 401K

Capital Raise Ends: November 16th

Funds Wired Deadline: November 13th

Distributions: Made monthly, beginning 4 months after the investment is made.

SOFT COMMITMENT

Please use the button below to put in your firm commitment amount. You must complete the firm commitment to secure a spot in the deal.

Firm commitments are on a first-come, first-serve basis.

We will follow up with everyone on the firm commit list with the PPM and steps to verify your accredited investor status (a requirement for a 506c offering).

Single Family Turnkey

Multifamily Syndication

© 2023 Altus Investment Group. All rights reserved.